We’re all familiar with the expression ‘money doesn’t grow on trees’. Politicians often use it when they want to justify cuts to public services. And it is, of course, true. Money really doesn’t grow on trees. What is more rarely discussed, though, in relation to how public services may be financed, is just where money does come from. I would like to offer a brief account of where money comes from.

Money is created when people borrow it from banks. Suppose I want a mortgage to buy a house. I go to a bank and ask to borrow £100 000. The bank looks at my income, at the value of the house I want to buy, at my credit history and so forth, and then agrees to lend me the money. At that point, the bank credits my current account, which may be with the same bank or with another financial institution, with £100 000 and at the same time opens a new account in my name which has a balance of -£100 000. This second account is the mortage which I must, over time, repay. The £100 000 which is deposited in my current account is new money which can then be used to pay for things. I can arrange for it to be transferred to the account of the seller of the house, in exchange for the house. The seller of the house can then use that money to buy goods and services. This is how money is created. It is created by being borrowed from banks.

This might seem strange. I think many of us intuitively feel that banks play an intermediary role between savers and borrowers, and that the banks lend out to borrowers money that has been previously deposited in the banks by savers. I think we feel that this must be the case because in our everyday lives we cannot lend something that we don’t have. Whether it’s money or sugar, we can only lend something to someone else if we have first acquired it ourselves. Banks, though, are different. Banks are licensed to create money by lending it. I realise that this is a startling idea, but if you still doubt it I’d ask you to consider, then, just where, if it doesn’t come into existence by banks lending it, money does come from (remember, it doesn’t grow on trees).

Money comes into existence when people borrow it from banks. Every time someone borrows money from a bank one account in that person’s name is credited and another account, also in that person’s name, is debited. That person may then use the money in the account that has a positive balance to buy things. Let’s look again at the example in which I borrow £100 000 to buy a house.

The bank agrees to make me the loan. It credits my current account with £100 000, and opens a new account in my name with a balance of -£100 000. I then transfer the £100 000 from my current account to the current account of the seller of the house. Now, I owe £100 000 to the bank and the seller of the house has £100 000 that they can spend on other stuff. I no longer have £100 000 credit in my current account but I still have -£100 000 in my mortgage account. The £100 000 credit is now in the account of the seller of the house, and from there it may be transferred to the accounts of shops and restaurants and garages where the seller of the house uses it to purchase goods and services.

All money is like this. If someone has an account with a positive balance it is because that same person, or someone else, has another account with a negative balance. Accounts with a positive balance are only possible because of other accounts with a negative balance. If positive balances in some accounts rise, then negative balances in other accounts must also rise. A simple way to think of it is like this.

savings (positive balances) – debts (negative balances) = 0

Let’s write this as

S – D = 0

Now, of course, some people like to save. That is, they maintain accounts with a positive balance, and they add to that positive balance. I think we can easily see that doing this is only possible if there are others who are accumulating debt. If S rises, then D must also rise, since S – D = 0.

We can distinguish, though, between two types of debt. There is private sector debt, and there is government debt. Let’s call these PD (private sector debt, the debt of individuals and firms) and GD (government debt). Now,

S – (PD + GD) = 0

I think it is clear from this that any reduction in government debt will necessarily entail either a rise in private sector debt or a fall in savings, and also that if the level of savings rises then either the level of private sector debt, or the level of government debt (or both) must rise. Sadly, when politicians bemoan the level of government debt, journalists do not typically ask them whether they would prefer to see the level of savings fall, or the level of private debt to rise. If government debt falls then either the level of savings in the economy must fall, or the level of private sector debt must rise. Every time a politician says they want to cut the deficit they should be asked whether they want to stop the level of savings from rising, or if they want to see the level of private sector debt rise.

The only direct way that goverments could prevent the level of savings from rising would be by confiscating savings. I think it’s safe to say that this option is politically unpalatable, especially amongst exactly those conservative politicians who insist most strongly on the need to cut the deficit.

The alternative, in periods during which the level of savings is rising, would be to allow the level of private debt to rise. High levels of private debt, though, are extremely dangerous, as we saw in 2007. As a person’s debt grows they begin to worry more and more about whether they will ever be able to repay it, and the lenders also worry more and more about whether they will ever get their money back. Either way, people spend less, either because they want to reduce their debts or because others will no longer lend them money to spend. This is how recessions happen. Consumers wish to reduce their debt, or are forced to reduce their debt, so they stop spending so much. By doing this, though, they succeed only in putting each other out of work. When consumers reduce their spending employers lay off staff, since it’s no longer profitable for them to continue to employ so many staff. When staff are laid off their ability to spend money on goods and services is reduced further, which leads to employers laying off more staff still, and so on. The economist Irving Fisher put this well when he said,

‘the more debtors pay, the more they owe.’

As people seek to reduce their debts they reduce each other’s income, which serves only to increase their debts.

Government debt, though, is different, at least in the case of the government of a country with its own central bank and its own currency. Remember, money is created when banks lend it. If it were absolutely necessary, a central bank could create more money by lending money to itself (in fact, this is how central banks finance quantitative easing). This means that the government of a country with its own central bank could never be in a position where it was unable to repay its debts. It would always be able to borrow money from its own central bank with which to repay its creditors. I am not recommending that governments actually do this to finance their spending but the fact that they could do it if it were necessary means that lenders need not worry about governments being unable to repay in the way that they worry about private borrowers being unable to repay. High levels of government debt will not lead to recession in the way that high levels of private sector debt will lead to recession.

The upshot is this. Since S – (PD + GD) = 0, if S rises then either PD or GD must rise. As long as people want to save the only way of preventing S from rising is for government to somehow prevent people from saving. If PD rises to the point where lenders begin to worry about whether they will get their money back then the economy goes into recession. The only remaining option appears to be to allow GD to rise. Rising GD is the government deficit. Rising levels of government debt are much, much less dangerous than rising levels of private sector debt, for the reasons I’ve outlined above. Unless the government has a workable plan to stop the level of savings from rising then the only alternative to rising private sector debt is rising government debt. During periods in which people want to increase their savings governments can do one of three things.

a) limit how much people can save

b) allow the level of private debt to rise

or

c) allow the level of government debt to rise

Next time you hear a politician say that they want to eliminate the deficit (i.e. stop government debt from rising) please ask them which of a) or b) they prefer. Do they want to stop people from saving money, or do they want people to accumulate unsustainable levels of debt? Eliminating the government deficit necessarily entails doing at least one of those two things.

“If someone has an account with a positive balance it is because that same person, or someone else, has another account with a negative balance.” That, presumably, would be true even if neither was a saver. The ricochet of money through the economy is – I’m guessing – not the concern that motivates “what will become of us” writing. The true saver stymies the function of money just as the borrower facilitates it. So, “If positive balances in some accounts rise, then negative balances in other accounts must also rise”, means if an economic actor retains what they obtain, the first (say) £100,000 loan ceases to function as money with that £100,000 savings balance. It might have done its work in facilitating transactions to quite a remarkable degree before that stage. These transactions could have resulted in many assets, each of which provides the basis for a further loan, and the creation of more money. Experience suggests that this process getting out of hand is more of a problem than the failure of money to allow exchange. Some, of course, “maintain accounts with a positive balance, and they add to that positive balance. I think we can easily see that doing this is only possible if there are others who are accumulating debt.” This is disinflationary. It, other things being equal, puts downward pressure on interest rates. It results in inducements to spend, and – experience suggests – this quickly produces dissaving. “[W]hen politicians bemoan the level of government debt, journalists do not typically ask them whether they would prefer to see the level of savings fall”. What reply would we give if they said they would like to see the level of savings fall? “The only direct way that goverments could prevent the level of savings from rising would be by confiscating savings.” This, of course, involves characterising negative interest rates as “confiscation”. “High levels of private debt, though, are extremely dangerous, as we saw in 2007.” Why is this the case? If those making reckless loans made losses, and if banks went bust – their assets sold by the receivers and the new-co institutions able to make loans – why would this debt be “dangerous”? Why wouldn’t this doubtless right-wing approach not act as an immediate check on this debt, creating an exquisitely sensitive regulation on all of the stupidities which (supposedly) are as unavoidable as their progressive after-the-fact palliatives? This possible world might be one where the statement “..people spend less, either because they want to reduce their debts or because others will no longer lend them money to spend. This is how recessions happen”, becomes an historical account of what we stupidly once did, rather than a law of nature. It’s possible, after all, that it’s the regular administering of the cure which makes it possible for us to continually acquire the disease: penicillin puts sailors in brothels. “[A] country with its own central bank could never be in a position where it was unable to repay its debts.” This isn’t true for index-linked debt, or there’s at least more of a problem in this statement than you might think. “[L]enders need not worry about governments being unable to repay in the way that they worry about private borrowers being unable to repay. ” This is simply false. Lenders are sophisticated economic actors. They demand repayment in purchasing power: they demand that money be a tool to buy paper – and an infinity of other things. It can’t just be paper. “High levels of government debt will not lead to recession in the way that high levels of private sector debt will lead to recession.” High levels of government debt lead to a currency crisis: people stop accepting your paper because they think you’re so up to your ears in debt that you’ll have to allow unchecked inflation to get out of it. Money dies, and that just so produces recessions. “Rising levels of government debt are much, much less dangerous than rising levels of private sector debt, for the reasons I’ve outlined above. ” No, government debt is much more dangerous, because third parties don’t care if fools lose money lending to British car purchasers. They do, though, worry about a government that has no way out of its predicament but to destroy the means of exchange. “During periods in which people want to increase their savings governments can do one of three things.” I love the “do”. As if government could, does and should control all of civil society. Maybe a sustained period of less “do” might demonstrate that having the stupid pay for their stupidity produces exactly the benefits that 19th century liberalism identified. Let’s see what banks do when the evaporation of their core capital – rather than the removal of a CEO’s knighthood – is the price to be paid for stupidity.

“Next time you hear a politician say…”. I’ve got a better idea. The next time you hear a progressive say something, interrupt and insist that you wouldn’t have started from here, and they aren’t entitled to demand that you do.

LikeLike

I don’t think that exeperience suggests what you so glibly suggest that it suggests. The oft cited instances of hyperinflation which deficit scolds repeatedly invoke are all, always, caused by specific political circumstances and are never caused by simply ‘this process getting out of hand’. Hyperinflation in Zimbabwe was caused by a collapse in production due to a huge political crisis. In Venezuela it was caused by a huge fall in the price of Venezuela’s only significant export. In Weimar Germany it was caused by the government’s obligation to pay war reparations in gold.

The reply I would give to a politician who said they would like to see the level of savings fall is ‘& how do you propose to make that happen?’

Yes, saving is disinflationary. Now would probably be a good time to point out that disinflation is very, very bad. Prices fall, hiring workers becomes less profitable, or not profitable at all. Companies lay off staff. Rising unemployment further increases deflationary pressure. More lay offs. etc etc. Depression. Mass unemployment. Rise of fascism. War. (On the upside, though, war causes deficit spending by governments and lays foundation for happy post-bellum period)

It’s tempting, of course, to say that those who made reckless loans prior to 2008 should simply swallow their losses, but this might be a bit unfair. They were only doing, after all, what policy makers had hoped they would do. Money has to come from somewhere. If it is not coming from deficit spending by the government it must come from lending by commercial banks. Initially, the loans made by the banks will be prudent loans. As time goes on and as the government continues to fail to play its part, the loans made by the banks will become progressively less prudent, as the opportunities for prudent lending are steadily exhausted. This is the lesson of 2008. It’s probably worth remembering that all the irresponsible lending that led to the great financial crisis is also what kept the economy afloat in the years leading up to the great financial crisis.

Any political or economic commentator who deserves to be taken seriously must of course submit to the condition that we ‘start .. from here.’ Even if nothing else is obvious, this is.

LikeLike

“Any political or economic commentator who deserves to be taken seriously must of course submit to the condition that we ‘start .. from here.’ Even if nothing else is obvious, this is.”

Really? So if quacks – and gastric bands – produce the fat, anyone who suggests that surgically helping Sarah (and let’s suppose that’s genuinely her best option) will produce a thousand like her, can be condemned for their lack of Sarah-focus?

That’s what I love about the left. It’s never enough for the poor to not need to be saved, they have to stand in permanent need of an intervention force of Guardian readers. George Galloway became misty-eyed as he described the famous white dove settling on dear old thuggish Fidel’s shoulder. As Eric Hoffer pointed out long ago in “The True Believer”, the symptomatology of religious and ideological belief is so similar we can only conclude that it springs from the same source.

One dollar in 1914 would buy what twenty four buys today. Doubtless some incredible exculpatory and theory-saving explanation is available to account for this endless debasement of the currency; Weimar Germany, Zimbabwe, Venezuela…..the world’s only hyperpower, each blown off course by extraordinary events.

An act – saving – is disinflationary, and this eo ipso “..is very, very bad.” No. Deflation is bad, but in the context of centuries of inflation disinflationary acts are often “…very, very good”.

We’re told money “..must come from lending by commercial banks” and – unavoidably – “the loans made by the banks will become progressively less prudent, as the opportunities for prudent lending are steadily exhausted.” So there you have it. They’re incapable of prudence. Congenitally. No matter the threat of losses (which the left, remarkably, likes to remove) they just have to put themselves in the position to make them.

It’s only the “unfairness” that prevents us allowing rich idiots to pick up their losses? So it might make perfect sense, but would be “unfair”? Next time let’s be “unfair”, eh? Now that we’ve seen the alternative.

LikeLike

OK. We agree that deflation is bad. And we agree that saving is disinflationary. I think then we must agree that there are periods when levels of saving are higher than would be desirable. If we can just go one step further and agree that, during those periods, government might want to take steps to offset the depressionary effect of excessive saving then we’ve pretty much agreed on the whole kaboodle.

LikeLike

On your last paragraph; I was not seeking to appeal for clemency for Fred Goodwin. I was introducing the point that the extension of private credit from 80s up till 2008 was necessary given the absurd parsimony of governments during that period. Had it not been for all the irresponsible lending by banks we’d have faced huge unemployment. Irresponsible lending by the financial sector, of course, as we now know, is not the best way to avoid unemployment. Deficit spending by governments is the best way to avoid unemployment.

LikeLike

“…there are periods when levels of saving are higher than would be desirable”. We cannot make statements like this without introducing all the other real world considerations, and in particular the behavioural changes produced by the expectation of government measures.

We should also note the very great distinction between, i) the logical/arithmetical truth that if the world’s non-state actors considered in their entirety have a net saving balance there’s no money, and ii) the judgment that the money supply in a given country at some moment in time doesn’t facilitate all of the possible economic activity, and that measures to address this will in the round be a positive over time. We should also note that insisting that a non-state actor facilitate the money supply isn’t synonymous with the state’s deficit financing of its pre-recessionary spending habits.

What are we to make of the claim – which, to use Locke’s phrase, comes like a sister hand-in-hand with this talk of money – that states should deficit spend money to produce economic activity and then tax to control inflation, if any? Well, we might pause to contemplate the obvious fact that 100 years of positive interest rates, taxation and interest-bearing Treasury bills has been consistent with a dollar that has lost over 90% of its value. One pound in 1914 would buy you what £88 buys today, despite all that “unnecessary” interest and gilt issuance.

LikeLike

Yes. Deficit spending by most governments most of the time for the past century has kept inflation consistently above 0%. Exactly. Deficit spending is good. That’s what I said.

LikeLike

“Deficit spending by most governments most of the time for the past century has kept inflation consistently above 0%. Exactly. Deficit spending is good.”

Yes. So “good” that they’ve managed to debase their currencies to the extent that anyone who held the paper would struggle to know whether to spend it or wipe with it. So “good” that currencies have died. “Good” in the way that so many people manage to avoid starvation by becoming type II diabetics. And so very, very “good” that the disinflationary measures you deprecate – issuing gilts and paying interest, for example – haven’t served to much check the “goodness”.

Progressives worry about saving, but not investment. But it never occurs to them that savings would become investment if we allowed asset prices to reach their market level in the aftermath of bouts of collective madness. What did we do in 2008 when rich idiot bondholders had – as Dambisa Moyo pointed out – stood by as the banks they’d invested in went mad? We bailed them out. We made good the idiots’ losses using the money of the poor and the futures of the children of the poor. We allowed clowns who’d taken out £400,000 mortgages to receive £24,000 a year of mortgage interest in welfare payments, and then they can sell these properties at a capital gains tax-free profit, and keep the windfall the money of the poor bought them. Why didn’t we allow house prices to fall by 50%? If substitute goods theory holds that’s the real price. Where’s the evil in allowing banks to make huge losses, be sold by the receiver, and move on as new-cos to make productive loans? Where’s the evil in allowing savers to invest in their first property at a price that makes some sense? Where’s the evil in allowing savers to become landlords at prices that make the business viable? Where’s the evil in much lower rents, and a concomitant collapse in the housing benefit bill? Why do we imagine that those who buy with savings during downturns are “carpetbaggers”, wrongly taking advantage of those who “bought in good faith”; a.k.a. allowed their greed to drive them into the herd of other greedy groupthink idiots?

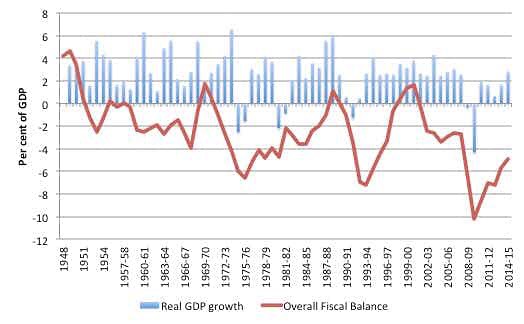

Governments were absudrly parsimonious from the 1980’s to 2008? UK government spending in the early 1980s was over 50% of GDP. In the years before the crisis it was over 40%. It has never been below 35.7%. The inflation figures make sobering reading. If we take 1987 as a base of 100 the RPI is now at 275. From 1980 to 2012 UK government spending – in real (inflation-adjusted) terms – grew from around £330bn to £700bn. Overwhelmingly this has not been through the purchase of services, but through transfer payments: not buying goods or services but taking from some to give to others. This all took place during i) the end of the cold war, ii) a remarkable growth in private sector opportunities, iii) a dramatic reduction in the cost of essentials and iv) a collapse in the cost of essentials as a percentage of average remuneration. I’m sure there’s evidence somewhere in this data for a terrible under-spend by government, and it’s doubtless a considerable failure on my part to fail to see it.

The average UK employee works £50,000 worth of plant and machinery. A public sector employee who invests – just to pick a figure at random – £600,000 in equities might be said to allow twelve people to earn a good living. But as the great Hayek said, by the end of the 19th century we’d got ourselves into a position where to provide jobs for a hundred was to be an evil exploiter, but to command a hundred was noble indeed. In the twenty first century being political commissar and chief apologist of such commanders presumably carries some similar status.

The left present themselves as the solution to the problems they cause. They do this because they’re certain that the world is full of evil and that they’ve grasped the solution. But behind all of this stands the grand old desire to hate and feel good about it. In the 1844 Economic and Philosophic Manuscripts Marx rails against the evil capitalists. But then he realizes that being “scientific” requires a “forgive them father, they know not what they do” dispassion. The great irony is that today’s progressives actually deserve precisely this indulgence. They don’t know that they need something else now that they can’t hate Jews, blacks or the Irish, so they hate Tories instead. How proudly a heart beats when some legitimating fig leaf is found for good old hate.

LikeLike

Firms ail when they cannot find customers. They also ail when the cannot find investors, but firms that can find customers can always find investors. A public sector employee who wants to help folk earn a living will do so better by treating herself to a holiday or a night out than by engaging in what can obviously only ever be the activity of a minority. We need many more customers than we need investors if investment is to show a return.

LikeLike

If the public sector workers really cared they’d – presumably – vote themselves a 200% pay rise and spend it as profligately as possible. You should stand for election and suggest it. Plato discussed this a while ago. Something to do with the difficulty a responsible politician has debating with a sausage seller, as I recall.

LikeLike

That’s silly. A 200% pay rise would certainly cause inflation. A 4 or 5% pay rise, though, almost certainly would not and might well lead to the government deficit coming down.

LikeLike

Oh no, Patrick. As you, Maduro, Mae West and the marching classes have always agreed: too much of a good thing can be wonderful.

To return to the issue of ideology – and the blindness people have for their own self-serving flavour of it – is there anywhere in your consciousness an alarm bell ringing? Is there nothing at all creating a pricking of your thumbs? Nothing? Nothing that makes you remotely suspicious of a theory that, i) puts you on the side of the angels, ii) makes you deaf to reasonable questions, and iii) entitles you to a windfall?

Nothing at all?

LikeLike

To say that people are blind to their own ideology is just to say that people think that their own beliefs are true. I should fucking hope that people think their own beliefs are true. What the fuck are we doing if we don’t think our own beliefs are true. Until as recently as 2015 I was very suspicious of the whole ‘austerity is a choice’ thing. I thought that what you had to say about economics was what economists had to say about economics and I granted, though it contradicted both my political preferences and my personal interests, that it was probably true. Then, I did some research.

LikeLike

“To say that people are blind to their own ideology is just to say that people think that their own beliefs are true”.

No, it’s to say more than that, particularly when i) we’re talking about wholesale worldviews (we all believe it’s true that cheese is made from milk), and ii) where the people stand to gain from the worldview (both in terms of pecuniary advantage and entitlement to hate).

I’ve asked you a hundred times why my preferred solutions can’t work, and all I get is more Yanis. Why shouldn’t FE lecturers who’ve overpaid for flats find that their capital gains evaporate? Why shouldn’t people who’ve made losses pick them up? Why shouldn’t “justice be done though the heavens fall”? Why wouldn’t less “Krugman” result in less future need for Krugman?

Whatever it is you read it isn’t the considered objections to your self-serving recitation of the beliefs that suit the class you belong to.

LikeLike

The answer to your question, for the hundredth time, is that it would cause catastrophic deflation.

LikeLike

Tell me – for the first time – why jam (to use our much loved example) is better at £2 a jar, than a pound? If I get paid half what I was paid before, and everything I buy is half the price, and my debts are gone – we’ve gone through administration – how much lower is my income? I’m poorer – we recognised the real value of my stupid flat – but do I have a lower income?

Your position is that debts owed to idiots who loaned recklessly must be repaid, and assets acquired by other idiots using borrowed money should be retained by the person who “put down 3% in good faith, and shouldn’t be ruined by negative equity”.

So, in summary we’ve got i) tubes who loaned to purchasers, ii) tubes who borrowed from these tubes to buy assets, and iii) people with savings balances. You hate “iii” for their unwillingness to “boost the economy” and facilitate the continuation of – God knows, dog fondling services, eyebrow shaping, whatever – which served as the economic rationale for “i’s” stupid loan, and “ii’s” stupid borrowing.

You’re certain that bankruptcy for “i” (including banks), bankruptcy for “ii”, purchase of the property or other asset by “iii”, and new lower rents and prices for manufactured goods, is impossible. Having homeowners become renters of the same property for a rent half of their previous mortgage interest is bad because the very process of recognising reality is – remarkably – inferior to living a national lie. “Extend and pretend” – the newly discovered fourth volume of Marx’s Capital.

Basically you owe me a million, and I owe you a million, and if we don’t agree that each of us has a viable dog fondling business neither of us can be millionaires.

LikeLike

My hunch is that the process of going through the administration, given the many millions of people involved, will take decades, entail mass unemployment and trigger a third world war.

LikeLike

Your “hunch” – of course – based on no grasp of the process at all. The administrators run the business as a going concern if that maximises the returns to the creditors, it happens all the time, it’s well understood, it’s un-problematic, the Americans have different tiers and types, the assets are frequently bought by the previous management……

Fine. You want to give rich idiots their money back and wreck the lives of the people who claim to care about? Fine.

LikeLike

OK. Let’s do it your way. See afterwards, though, we’ll still need government to run deficits, for the reasons I explained in the blog. In fact, we’ll need governments to run much larger deficits since I would imagine there will be, following so gruelling a round of finger-burning, very little appetite on the part of banks to lend money into existence.

Also, doesn’t your proposal entail doubling the government’s debt? Yes, if I earn half as much as I used to but a jar of jam, formerly £2, is now £1, then, ignoring frictions and political complications, nothing substantial has changed in respect of the price of a jar of jam. Still, our government’s debt, presently, say, £1.5 trillion, would remain £1.5 trillion (would be, that is, £3 trillion in today’s money) You want to increase government debt by that much so quickly? Wow.

LikeLike

Your point about government debt shows thought, but my point about real income and prices doesn’t involve conceding that we all suddenly get paid half what we were paid in nominal terms just because assets move to new owners. Why would it? British whisky sells against cognac and bourbon. Eliminating zombie companies by recognising that they’re owned by their bondholders – and they, while not penniless like the equity holders, have shares worth half what their bonds were (face value) worth – doesn’t mean a meaningful downward revision in remuneration. Why would it? If I rent the house I once owned for £300, where once I paid £600 in mortgage interest, the rent paid to the person who bought the house from the administrators of the bankrupt bank, why am I not – in every meaningful sense – better off? If, indeed, as often would be the case, I – after bankruptcy – made the best offer to the bank, and bought it for a third of what I’d first paid for it, why am I not better off? And remember, these run-of-the-mill applications of the rule of law should exist against a backdrop where they’re known to apply. You insist on the precise opposite. You demand the propagation of the well-founded belief that the rules won’t be applied, and then come forward as the solution to the problem that belief creates. One more drink economic: it stops the delirium tremens, but questions need to be asked of the dog as to the wisdom of its hair. You laud your skill with a tourniquet and reject a guard for the machine.

As to us needing deficits always, you slide like Bambi on ice between a claim about the world in its entirety eliminating money through saving, and the claim that government can usefully deploy the assets the best judgement in the world chooses to leave fallow.

LikeLike

I think it a general truth that, for the profit motive to do its job, total private sector income over a period must exceed total private sector expenditure. For this to be the case total government expenditure over the same period must exceed total government income. I grant that there may be periods when private sector income need not exceed private sector expenditure, as people prefer instead to invest in exciting new opportunities but since the return on these opportunities will be monetary these periods will be rare and brief.

LikeLike

Take me through why, with a money supply that’s apt for a dynamic and productive economy, we need i) vast transfers of purchasing power between private individuals, and/or ii) government purchasing of private sector output with flat fiat non-gilt money.

LikeLike

If a ball bounces randomly around a room with a hole in the floor we can confidently predict it will wind up in the hole. Similarly, £s facilitate exchange by being transferred from account to account. Like the hole in the floor, the a/c of savers does not exert any special attraction on the £, but at some point any given £ will find itself in the a/c of someone who is inclined to hold onto it for a very long time. At that point it stops facilitating exchange. If the money supply is to remain ‘apt … for a dynamic and productive economy’ it must be topped up.

One way for government to do this is by means of the much maligned ‘printing money’. Another is for government to borrow the money from the saver and spend it on providing public services. This way the saver gets to continue saving (indeed has been provided with a super-safe savings opportunity) & the £ can once again resume its work of facilitating exchange.

LikeLike

That won’t do, I’m afraid. You also slide between supposed points about profits and claims about savings. I’ve said repeatedly – and you’ve ignored it repeatedly – that we’ve debased money in a quite remarkable way. You’ve no account of the money supply which serves to justify the claims you make for the role of government.

Sit down and work out whether the necessary expansion of the money supply given voluntary activity can serve as a justification for the actual role of government in our lives, and the growth of debt. Separate this account from any claim that present debt will become un-problematic if the economy grows faster than the debt. Let’s park that. Explain the basis for your assertion that the monetary issues you identify require the fiscal responses you favour. Explain the relative “scales” to me. So far as I’m aware we’ve never been close to net global private saving. That £1 in 1914 bought what £88 buys now is a mightily inconvenient fact for you. You’re a doctor selling weight gain powder to the clinically obese. So, to reiterate, explain the relative “scales”. Individuals trade, clever deployment of resources produces profits, these trend to “normal” profits over time, the average rate of return for nearly two centuries has been 5.1% for shares, 1.2% for bonds and 0.8% for cash. Currencies have died repeatedly, and inflation has been chronic.

Take me through it. What’s the monetary problem to which you and John McDonnell are the answer?

LikeLike

The present very high levels of household debt are the problem to which John and I are the answer.

LikeLike

…and the circumstances which produced this, the likelihood that your measures will produce more of it, the availability of an alternative – bankruptcy and clean slates all round – deters you not a moment.

Nor, indeed, did the request to address the question, “Can we justify government’s practices – and that enlargement of its role favoured by the progressive left – on the basis that maintaining the money supply requires it?”

Again, you slide from supposed logical verities about money to claims about the optimal use of resources: “Shipbuilding Shug can dance with Darcey, and you’re a fool not to watch because we debased your savings to pay for it”.

LikeLike

‘the circumstances which produced this’ = capitalism itself. Debt, ever rising debt, is intrinsic to capitalism. If you don’t like it, fine, but then you don’t like capitalism. I do not believe your alternative is possible. It would be lethally deflationary. I am not sliding. I don’t think I’ve made a single claim about the ‘optimal use of resources’.

LikeLike

Capitalism certainly doesn’t exist with your “stabilising”. What we get is what we’ve got: private gains (for managers, not owners) and then the socialising of losses. You must be very proud.

LikeLike

No, lending – generally collateralised – is intrinsic to our kind of money system. Your love of “Lending Stavros 50,000 Euro to “buy” the car we’ve made, with no need to pay back, and no need to recognise that we’ve just given him the car” isn’t capitalism. Nobody with a couple of quid and the sense God gave fruit would sign up for that.

What – precisely – does the progressive “spend to create employment and demand” policy amount to but an implicit claim that i) there’s lots to be done, ii) resources to do it, iii) at a cost that makes sense or iv) at no cost at all?

LikeLike

It amounts to the claim that capitalism cannot function without the stabilising effects of a state sector.

LikeLike

Capitalism certainly doesn’t exist with your “stabilising”. What we get is what we’ve got: private gains (for managers, not owners) and then the socialising of losses. You must be very proud.

[Attempt to reply 2.0. Presumably the state will be along shortly to bail me out for the losses produced by my earlier screw up].

LikeLike

https://www.economicshelp.org/blog/135320/economics/labour-share-of-gdp/

LikeLike

Yeah. Jesus. And that’s it?

4:48 “..there’s this sort of secular trendy where the [definite article] rising productivity makes it harder and harder in a market economy to generate sufficient demand to hire everybody who’s willing to work”.

Well, you John and Jeremy would certainly solve that rising productivity problem. We should get some wooden clogs and use them to break the machines.

LikeLike

For the sake of clarification, I should spell out that I entirely accept that if the velocity of money is high, then the government deficit can be low. If the velocity of money is extremely high then the government can run a surplus. Similarly, if the trade deficit were to fall then the government deficit, too, could fall and if the UK were to run a trade surplus then its government could run a fiscal surplus. My point is that this is the way the causation runs. If we want to cut the government deficit we have to do it by increasing the velocity of money & reducing the trade deficit (in practice, unless we want to introduce import controls, the two will go together – the velocity of money is made sluggish by people’s inclination to save in £s, the trade deficit is a function of foreigners’ inclination to save in £s). Trying to reduce the government’s deficit by cutting welfare or provision of public services will not work, indeed, by tending to reduce the velocity of money, is likely to have the opposite effect from the desired one.

LikeLike

Wow. So many irrelevancies and misconceptions all in one spot.

>>”Yes. So “good” that they’ve managed to debase their currencies to the extent that anyone who held the paper would struggle to know whether to spend it or wipe with it. > So “good” that currencies have died. “Good” in the way that so many people manage to avoid starvation by becoming type II diabetics. And so very, very “good” that the disinflationary measures you deprecate – issuing gilts and paying interest, for example – haven’t served to much check the “goodness”. >Governments were absudrly parsimonious from the 1980’s to 2008? UK government spending in the early 1980s was over 50% of GDP. > But it never occurs to them that savings would become investment if we allowed asset prices to reach their market level in the aftermath of bouts of collective madness. <– well no. Savings don't become investment, especially now that finance can make a lot more gambling on derivatives and manipulating commodities markets. You know that inflation is actually more a result of credit expansion than money supply expansion, right? A very short perusal of the crazy disconnect between housing and wages makes that abundantly clear. Prices rise according to what creditors will shell out, absolutely independent of inputs and wages, obviously. NINJA loans, remember? In a credit-based economy, lacking sufficient real currency, there are no real price signals that have anything to do with reality.

And it could all have been prevented by simply ensuring that the people had enough money to *not have to borrow.* This can easily be accomplished by government policy and would have halted the voracious expansion of finance to the ridiculously large market segment it now holds.

Of course, those that oppose government provision of unencumbered cash never see anything wrong with the unlimited creation of encumbered money and the resulting poverty, transfer of wealth from the wealth creators to the rentiers and the resulting crashes.

History has shown numerous times that government directly employing workers, putting cash they don't have to pay back into their pockets, is the most effective way to revive a sagging economy. Good welfare policies are nearly as effective. It's quite a simple math problem, really. 1 pound in the pocket of several million people leads to an instant boost of several million pounds to the economy. Several million pounds to 1 rich guy is unlikely to be spent at all, unless it's on already existing goods like old masters' paintings and rare wine vintages. It's *most* likely to be "invested" in savings instruments. Adding money to the bottom produces growth. Adding it to the top does not.

LikeLike

I was quite excited when I saw this; ready to read all about my misconceptions. And then I saw the usual ball of wool that the cat had been playing with, and another invitation to pointlessly try to unpick it.

LikeLike